Frequently Asked Questions (FAQs)

Submitting an Expenditure Correction via an AP Journal Voucher

No, corrections can only be processed for paid AP vouchers. Any corrections submitted for unpaid vouchers will be denied.

Staff with Reconciler access in PeopleSoft can submit an expenditure correction.

Users will submit an access request via UTRGV Support Center. Instructions are posted on the AP Training & Resources tab.

Corrections to an account code, cost center or project can be submitted.

No, expense corrections related to specific chart fields, such as fund code, department, or function, require processing via a GL journal and processed by Accounting for unrestricted cost centers and by Grants Accounting for restricted cost centers and grant projects. Please contact Accounting and Reporting or Grants Accounting for more information.

No, an InterDepartmental Transfer (IDT) does not source from the AP Module, and therefore cannot be processed by an AP journal voucher. Please contact Accounting and Reporting for more information.

Information from the monthly reconciliation report is required to submit a correction. Users can use the Sahara report or the GL Ad hoc Transaction Report. The Monthly Financial Report (MFR) can also be used, however it does not provide all the required information.

The supplier invoice number can be obtained from your monthly reconciliation reports in GL and Sahara. In the GL Adhoc Transactions report it’s reflected as the “Invoice Number” column. In the Sahara month reconciliation, reference the “Invoice ID”.

Enter the required format "CORR-VOUCHER#-PO#" in the description for all invoice lines, (e.g., CORR-R0012345-V00012345). Incorrect descriptions will result in a denial, requiring correction and resubmission.

Use the Voucher ID reflected in your SAHARA Monthly Reconciliation, which is the same as the Doc ID in your Monthly Financial Report (MFR). Include that voucher ID in the invoice line description "CORR-VOUCHER#-PO#”.

There is no limit to rows if the correction is for the same voucher.

The Budget Status within the Summary tab will read Exception. This link will provide details of the budget error.

Capital account code corrections will be routed to Assets Management for approval in the workflow.

Grant-related corrections will be routed to the grant accountant for approval in the workflow. Include justification, the MFR, and the original invoice in the comments and attachments. Corrections older than 90 days must include the Grants & Contracts Expenditure Correction Request Form. Consult with your grant accountant for guidance.

Yes, comments can be viewed within the approval chain of a submitted AP journal voucher.

Reconcilers must submit AP corrections by the last business day of the month, ensuring all reconciliation is done monthly.

Yes, but prior approval from the Accounting Office is required before submission.

Corrections not fully approved by the last business day will be reflected in the next accounting period once approved.

No, you can update and resubmit the denied or returned voucher without needing to create a new one.

As part of the AP month end closing, vouchers not resubmitted by the last business day will be deleted. A new journal voucher will need to be submitted.

Travel & Business expenses reimbursement

You may follow the steps outlined in the below user guide to submit business/travel reimbursement requests:

When you pay out-of-pocket to register for conferences or exams, you cannot submit your expenses until after the event has taken place.

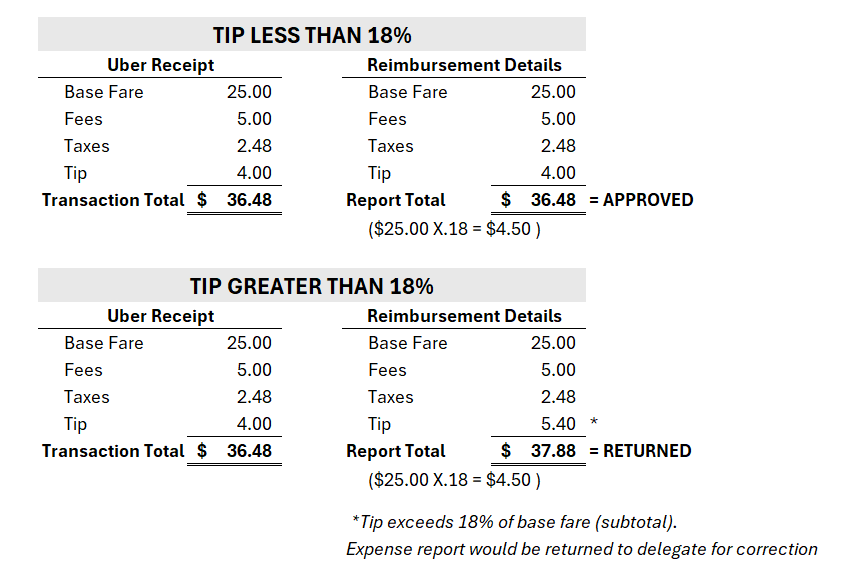

Travelers are eligible to receive reimbursement for business-related transportation, including base fare, additional fees, taxes, and tips. However, tips and gratuity reimbursement for taxis and ride-share companies will be limited to 18% of the pre-tax amount (base fare) plus any imposed fees.

Examples:

Yes, you are required to include the event start and end dates in the comment field of the expense report for tax liability assessment when submitting the conference or exam expenses reimbursement request. The start date is defined as the first date the conference or exam commences, and the end date is the last date these events are finished.

All employees will receive payment via ACH or check depending on what is setup in their PeopleSoft Employee Self-Service for reimbursements.

In accordance with IRS Publication 463, any reimbursement requests received after 60 days will be reported as taxable income to the employee, and subject to applicable federal and state taxes. The amounts will be withheld from the employee’s paycheck to cover the tax liabilities.

To avoid tax consequence, you are required to submit expense reports through Concur (iTravel) for out-of-pocket expenses within 60 days from the date the expense was incurred (in the case of travel, within 60 days from the trip end date) along with all supporting documentation.

A Business Expense Reimbursement policy should be used in iTravel+

All transactions should be expensed using Empl Moving Exp Nontax (67651) as the expense type. Please reference the Moving Expense Policy for examples of allowable/unallowable expenses.

Relocation expenses such as airfare are allowed for immediate family members of the UTRGV employee.

For State hold inquires, employees can call the State Comptroller of Public Accounts at 512-936-8138.

41XXXXXXXX = ACH

43XXXXXXXX = Wire Transfer

44XXXXXXXX = Outsourced Check

45XXXXXXXX = System check

48XXXXXXXX = ACH (Single-use account)

49XXXXXXXX = Wire Transfer (Dreyfus)

iShopUTRGV Electronic Invoice

iShopUTRGV Shoppers and above.

Accounts Payable will review duplicate invoices and contact the department to verify discrepancies. Please contact the AP department if you submitted an incorrect invoice.

iShopUTRGV serves as a delivery mechanism that allows for an invoice provided by

Invoices should be submitted as soon as

Users may verify the status of the invoice on the Purchase Order located in the invoice tab under "Invoice Status".

Yes, please ensure the vendor invoice indicates only the quantity and amount being invoiced. Please contact the Accounts Payable office at AccountsPayable@utrgv.edu for more information.

Departments will be responsible for submitting an invoice through iShopUTRGV. All invoice processing runs through iShopUTRGV. All information regarding invoice status is found in iShopUTRGV.

iShopUTRGV Reconcilers should verify requisition status.

Failure to post an invoice may result in exceeding the allotted 30 days in which we have to pay the vendor (Texas Prompt Pay Act) and the possibility of incurring late fees at a rate of 6.00% charged to the department.

Yes.

Note: the invoice might not be paid if a Quantity Receipt is necessary. If a Quantity Receipt is not needed then the invoice will be paid. Please contact the supplier on the status of your items.

As soon as an invoice from the supplier is received. If over the purchase order is $5,000.00 or more, then submit a quantity receipt as soon as items have been received. If an invoice has been submitted on an item $5,000.00 or more and a Quantity Receipt has not been submitted then the invoice will not be paid.

Note: Invoices are not required to be created by the department for "Showcased Suppliers". For more information contact the Accounts Payable department.

Yes, as long as there is a different invoice number for each invoice submitted.

Invoices in iShopUTRGV should only be created when the original supplier invoice has been received by the department.

Users must use the invoice number from the supplier invoice that was received.

Please use the following format as the supplier invoice number:

- Date invoice was received

- First three letters of the vendor's name

- Example: 092618DEL

41XXXXXXXX = ACH

43XXXXXXXX = Wire Transfer

44XXXXXXXX = Outsourced Check

45XXXXXXXX = System check

48XXXXXXXX = ACH (Single-use account)

49XXXXXXXX = Wire Transfer (Dreyfus)

iShopUTRGV Quantity/Cost Receipts

The requisition was set to "Blanket" and created a Blanket Purchase Order. Blanket PO's automatically default to Cost Receipt instead of Quantity Receipt. You will now indicate the monetary cost received instead of the quantity.

Accounts Payable will contact you twice, once via iShopUTRGV comment, and once via email. Failure to post a Quantity Receipt on purchases $5,000.00 or more may result in non-compliance with UTRGV Purchasing Policy.

Please contact the supplier for order status.

Yes, please create a receipt for each shipment you receive. If the order total is 5,000.00 or more, then Accounts Payable will not process payment to the supplier until the full order has been received. See question 2.

Creating a receipt for purchase orders less than $5,000.00 is not required. Receipts may still be created but will not be reviewed by Accounts Payable in order to process payment.

Once submitted, receipts cannot be changed. Please contact Accounts Payable if you submitted an incorrect receipt.

Please contact Accounts Payable immediately and let them know that you have not received your order and are unable to post a receipt. Please include your Purchase Order number when contacting AP.

Accounts Payable Memorandum Form

Use this form when requesting payment for non-procurement transactions. Payment is made using a Chartfield String.

For check pick up, please provide UTRGV contact name and telephone number.

(NOTE: If pick up information is not provided, a check will be mailed out.)

Always include the invoice being used to request payment.

Enter a detailed description of the Payment Request.

Yes, enter the supplier details including:

- Payee Name

- Mailing Address

- City

- State

- Zip Code

Enter the appropriate Invoice number. Invoice numbers come from the attached receipt or invoice.

Example: If you attach a receipt, the receipt number would be used as the Invoice Number. Please contact AccountsPayable@utrgv.edu for more information.

- NOTE: If receipt number is unavailable, use the following format:

- Memo Date

- First three letters of Payee Name

- Example Payee: Hector

- 110118HEC

- Example Payee: The University of Texas

- 110118UNI

Please use the resources below for more information on each field.

If Direct Deposit has been requested, please send a [SECURE] email to AccountsPayable@utrgv.edu. Please include payee:

- Bank Name

- Routing Number

- Account Number

- Requisition number of AP Memo

Add all appropriate attachments. Include all attachments that support the payment request.

Examples include but not limited to:

- Receipts

- Invoices

- Receipts received from the original payment

- Receipts from the Bursars Office

- Department Request for Refund forms.

No, please search for and select an appropriate Commodity Code and complete the Requisition.

- Commodity Code."00000000" should NOT be used. Only use "00000000" for Travel related requisitions.

Non-PO Payment Request Form

This form is designated for non-procurement transactions that do not require a purchase order or follow the standard purchasing process.

Each request must include justification, supporting documents, and a separate requisition.

As of 2/1/25, this form can only be used for virtual registration fees. Registrations involving travel are not permitted. For further inquiries, please contact the Travel Office at travel@utrgv.edu. If an exception is granted, the approval must be attached to the REQ as supporting documentation.

All requests require review by the Scholarships Office, which is now conducted through the iShop workflow as of October 2025, eliminating the need for email approval. For travel awards, include the award letter and the Dean of Students-approved Travel Request Form. Use account code 67112 (Awards Non-Employees).

Honorariums require the email/notification sent to the guest showing that UTRGV offered the gratuitous fee, along with a copy of the event flyer. The questions below must be answered and attached to the REQ.

- Did UTRGV offer an amount or is the Individual/Company charging their standard price? Please provide details as to how the amount was established.

- Is the individual employed with a state agency or University? If so, please provide agency/institution name and address.

- What services will be provided?

- Is this a one-time service or ongoing service?

- What is the name of the event?

- Will travel be involved?

NOTE: Honorariums for state employees must be reviewed by the Contracts Office before submission.

Employee payments require review and approval from HR before submission. The approval email from HR must be attached when submitting the request.

The Tax Compliance Office will review such transactions to determine tax requirements and withholding before Accounts Payable (AP) processes the transaction.

Accounts Payable will issue a 1099 for transactions exceeding $600 within a calendar year.

Yes, this form should not be used for purchasing, services, or encumbering funds. For expenses related to revenue (4XXXX) or liability (2XXXX) accounts, use the AP Memorandum Form in iShop.

No, wages and salaries must be reported on a W-2 form and cannot be processed with this form. For such matters, please contact HR.

Stipend Request Form

Use this form to request stipends for Non-UTRGV employees.

Note: Please contact HR with stipend request for University employees. This includes students employed with UTRGV.

The Stipend request must be for NON-UTRGV students and must include:

- FIRST & LAST NAME (All Capitalized)

- Physical Address (City State and Zip)

- Stipend Amount

- Payment Method (If ACH, banking information must be submitted via [Secure] email to Senior Accounting Tech assigned to the payment cycle.)

Requests received for active employees will be returned to the requester and must be submitted through HR.

Departments must contact the Financial Aid Office to request stipend approval.

Departments will then be required to attach the Financial Aid approval to the NON-PO form and submit the Stipend request via iShop.

NOTE: Stipend Requests for current UTRGV students must be approved by Financial Aid before being submitted via the NON-PO form in iShop. Stipend Requests for current UTRGV students submitted without prior approval from Financial Aid will be returned.

Texas Prompt Payment Act

Chapter 2251, Government Code (the Prompt Payment Law) makes a state university liable for interest accruing on any overdue payment. The Comptroller’s Office is required to automatically pay that interest at the same time the principal is paid.

The following are some examples of exempt payments:

- Employee reimbursements

- Tuition refunds

- Utility vendors

- Pass-through expenditures

- Payments to other State of Texas agencies or higher education institutions

- Advance payments, such as subscriptions, leases, etc.

- Payments for any goods or service where an invoice was not provided or required.

If a payment is subject to interest, it will be calculated as follows:

- Interest charges will be based upon the "Payment Due Date" which is derived from the invoice received

date and goods/services receipt date.

Late interest expenses will be charged to the appropriate department and speedtype. For sponsored projects, restricted cost centers, and state-funded E&G cost centers, the fees will be redirected to the AP Services cost center. If late fees are due to delayed submission of invoices, receipts, or documentation, the department will be required to provide a local/designated cost center to reclassify the expense.

The date will be taken from the "Invoice Date" field indicated on the electronic invoice submission in iShopUTRGV.

For goods and services over $5,000.00, the "Fully Received" status date of a quantity receipt or cost receipt in iShopUTRGV will be used.

For goods and services less than $5,000.00, the "Invoice Date" will be used as the "Receipt/Service" date.

The service date is the date when installation, inspection or testing is completed, and the equipment is found to meet specifications. The purchase order must clearly state that an installation, inspection or testing is required and any timeframe requirements (i.e. 30 day testing period.) Otherwise, the day the equipment was received will be the service date.

Payments should be scheduled to be paid as close to the 30-day limit as possible. Early payments may be made if a discount is available or if there is a contractual agreement to pay sooner.